The Only Platform Your

Multi-Location Team Needs

Hundreds of features built for scaling multi-location businesses and supported by industry experts. One login unlocks unlimited possibilities.

Trusted by top multi-location organizations nationwide

%*

%*

%*

*No Bullshit

Customer Retention

Customer Retention

We're not a technology company, we're a relationship company.

FYI, industry standard retention rate is 90%.

Here's a few reasons we can stand on this number:

We're not a technology company, we're a relationship company.

FYI, industry standard retention rate is 90%.

Here's a few reasons we can stand on this number:

10x

10x

10x

Customer's ROI with Woven

Customer's ROI with Woven

Customer's ROI with Woven

65

65

65

2024 Net Promoter Score (industry standard is 36)

2024 Net Promoter Score (industry standard is 36)

2024 Net Promoter Score (industry standard is 36)

92%

92%

92%

New Customers that come from Direct Referrals

New Customers that come from Direct Referrals

New Customers that come from Direct Referrals

Woven Works For You

Built for growing franchise systems and multi-location enterprises, Woven turns complexity into clarity—so you can focus on scaling with confidence.

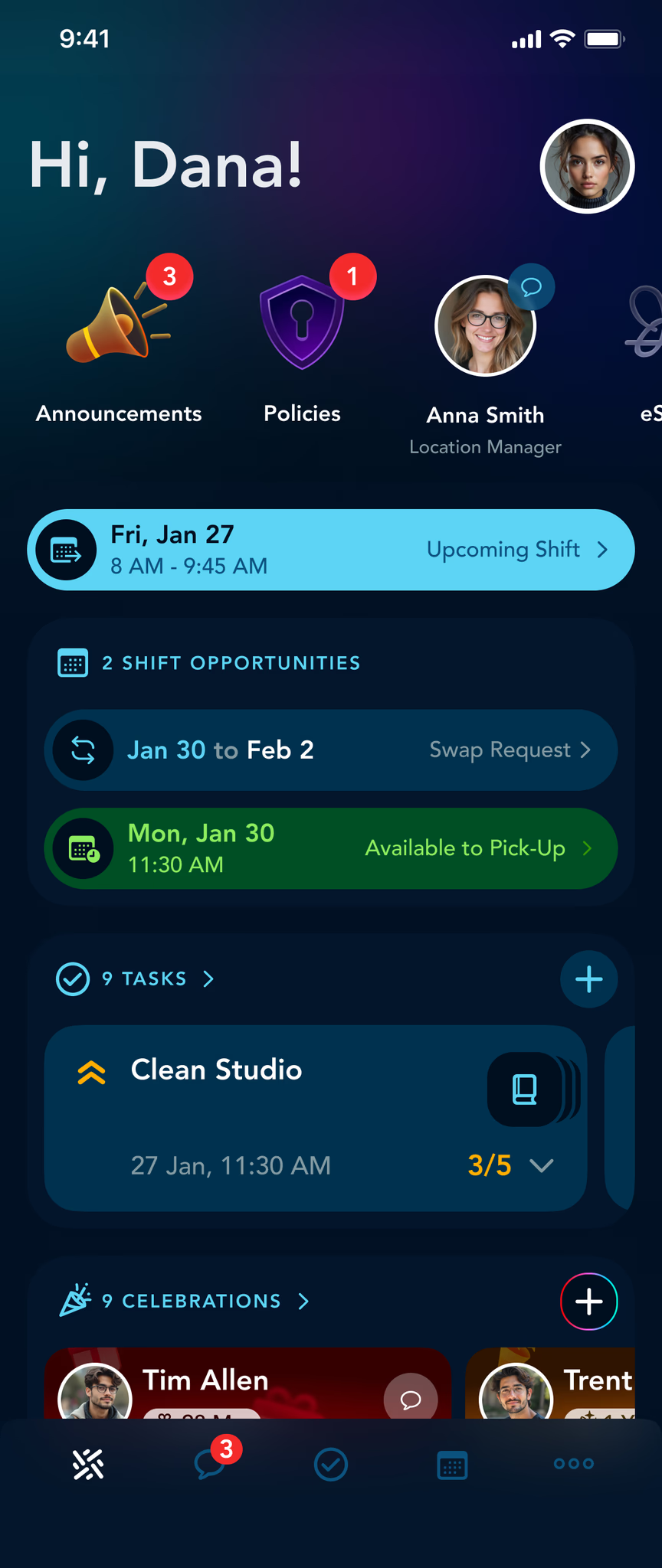

PEOPLE

Empower Your Frontline

Your people are your most valuable asset. Build a connected, engaged workforce across all locations with streamlined tools that eliminate silos and enhance productivity.

Seamless Onboarding

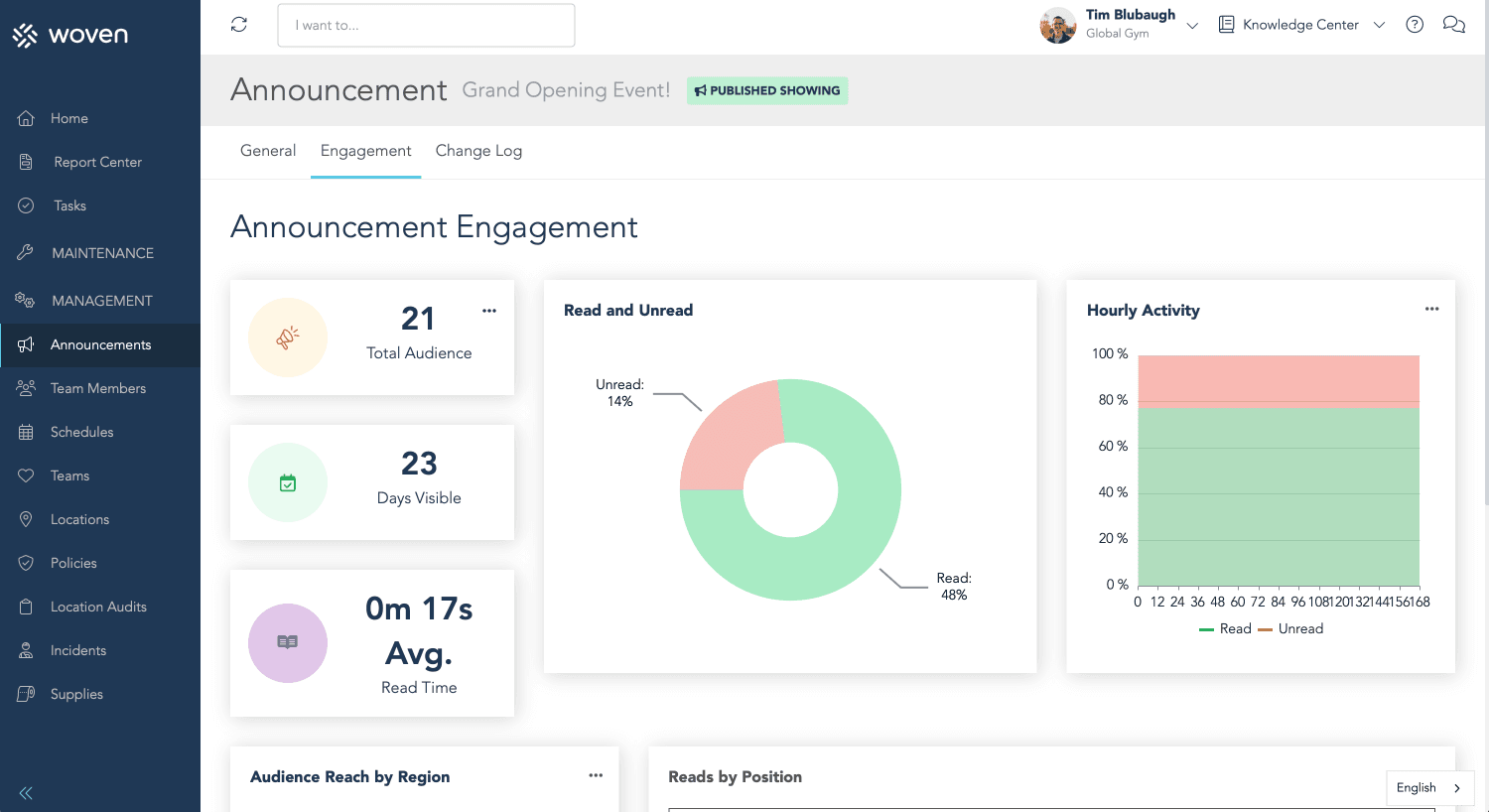

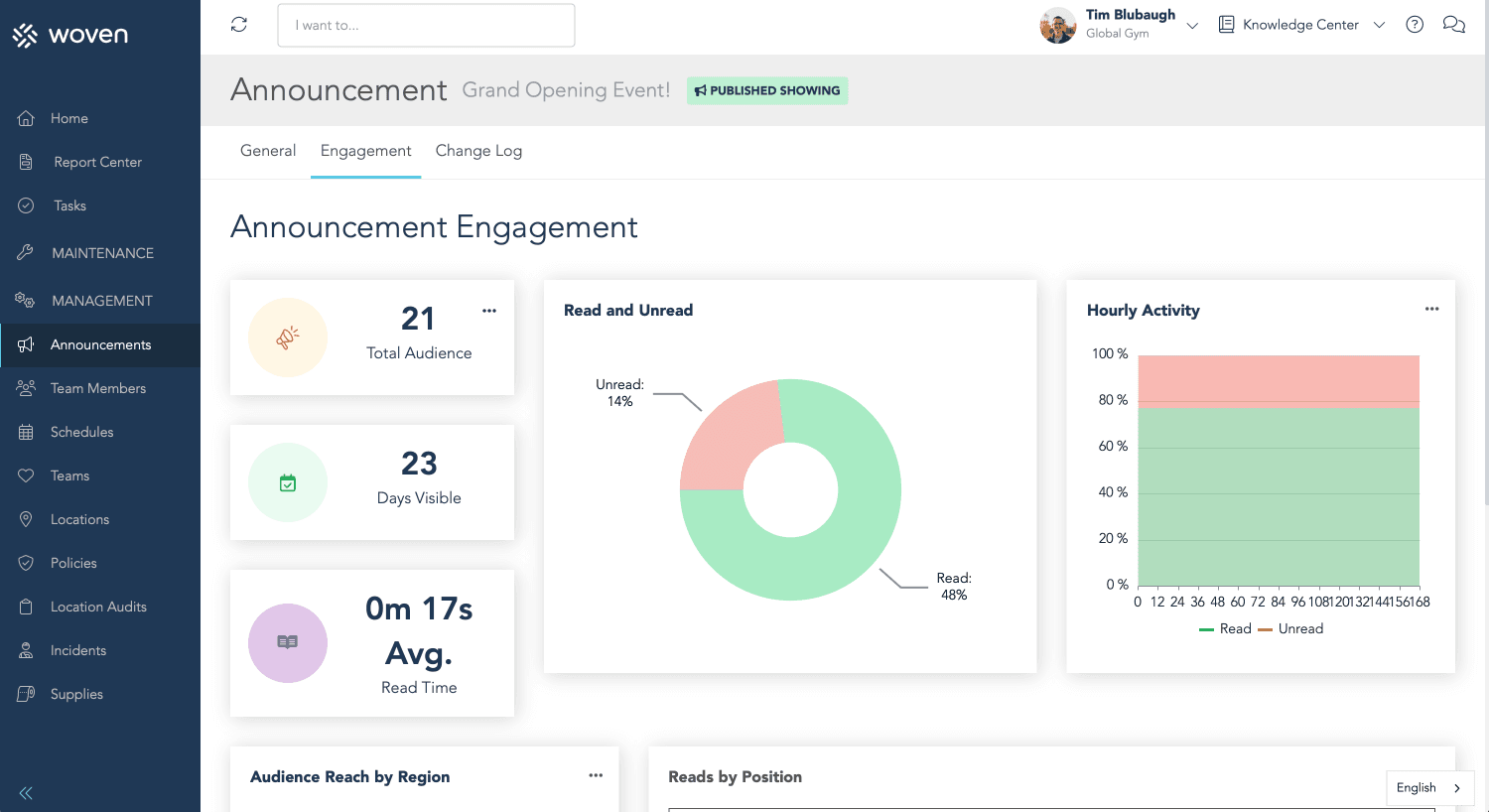

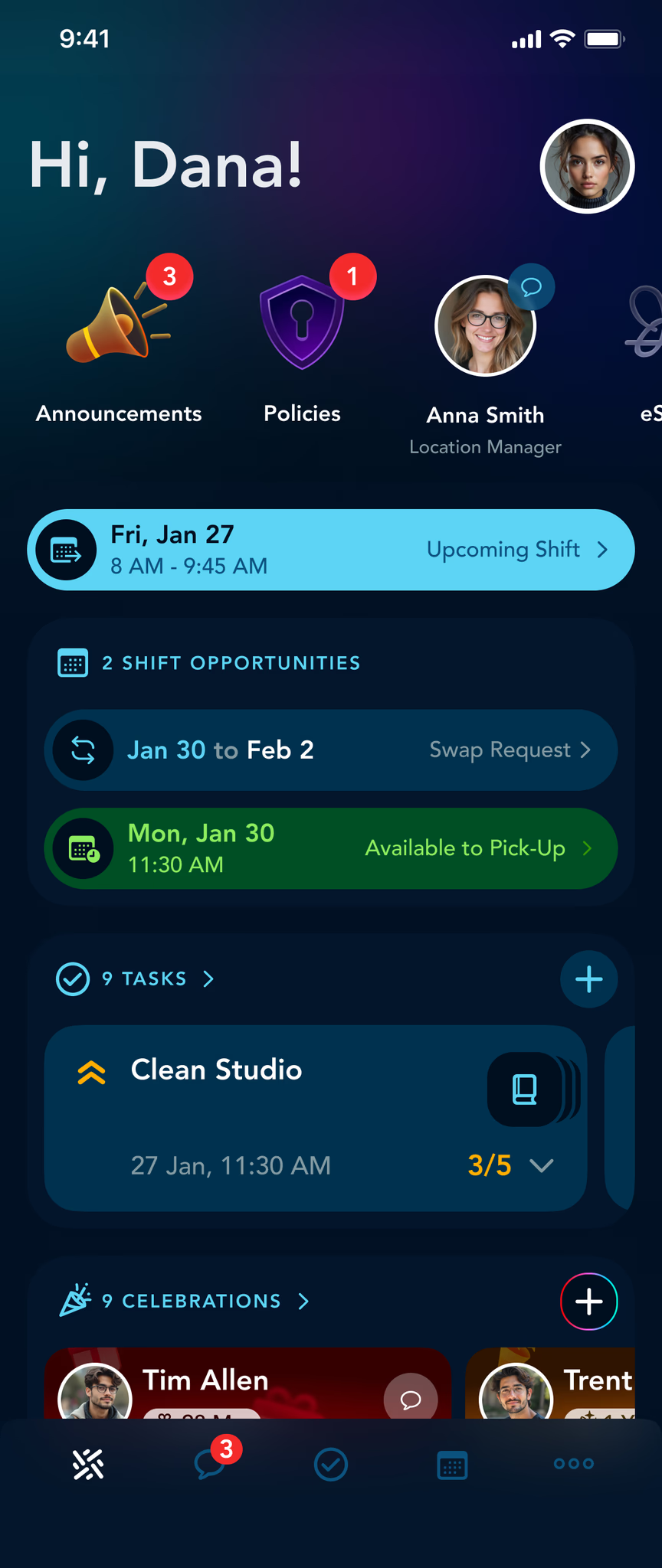

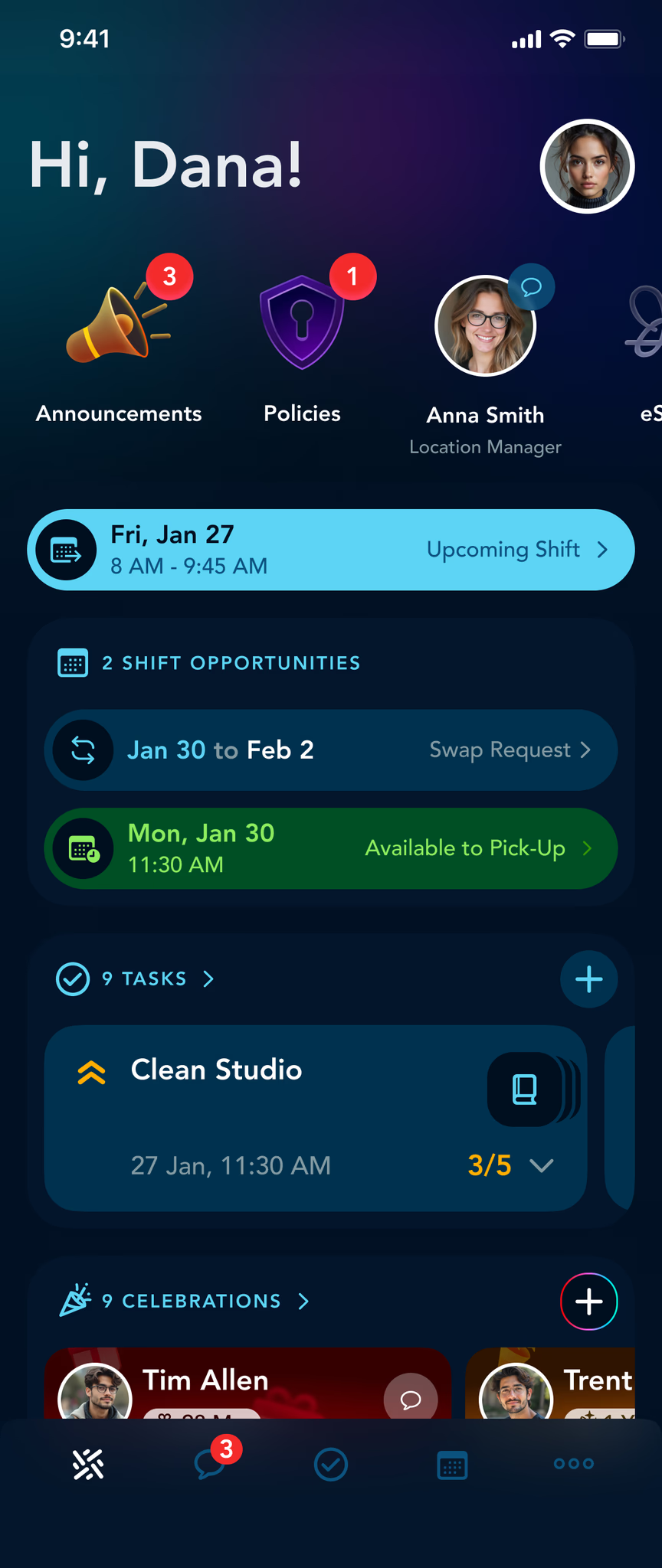

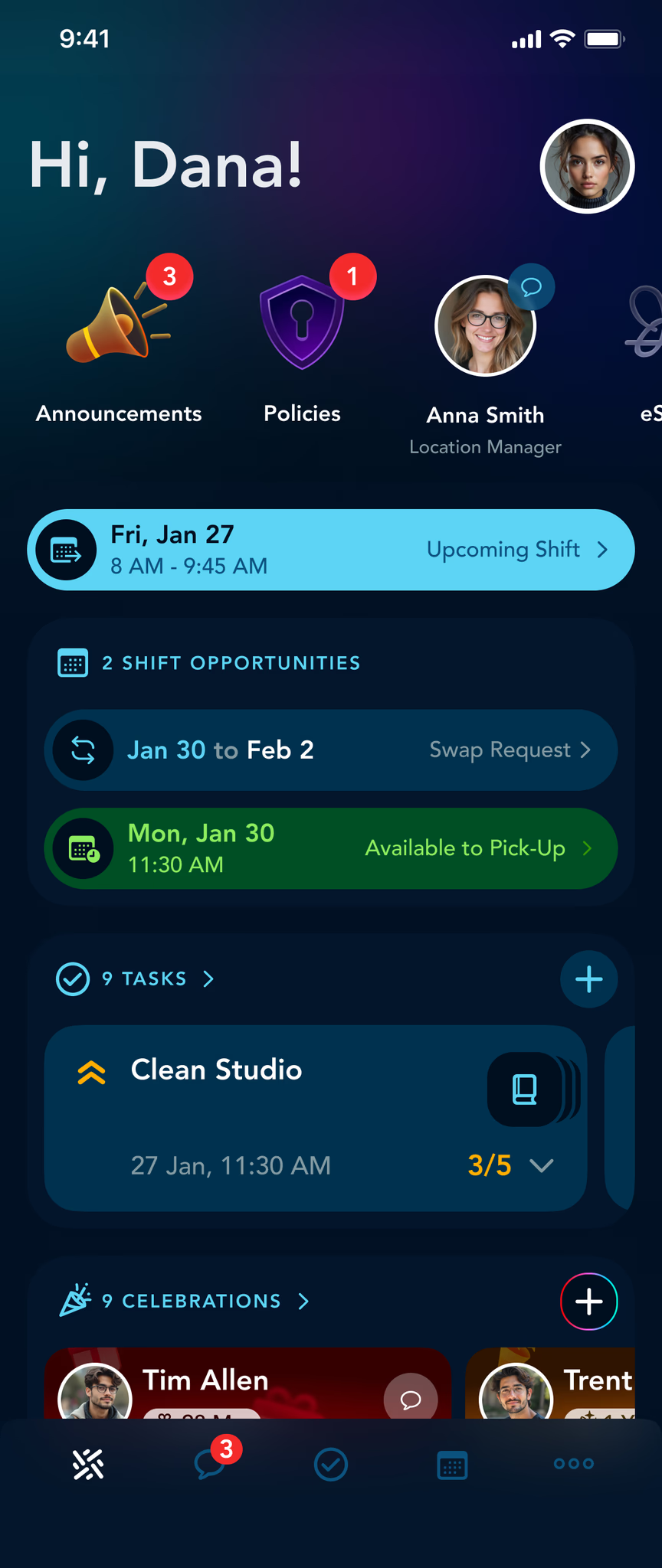

Communications

Learning & Development

Culture & Recognition

Employee Management

Self-Service

PEOPLE

Empower Your Frontline

Your people are your most valuable asset. Build a connected, engaged workforce across all locations with streamlined tools that eliminate silos and enhance productivity.

Seamless Onboarding

Communications

Learning & Development

Culture & Recognition

Employee Management

Self-Service

PEOPLE

Empower Your Frontline

Your people are your most valuable asset. Build a connected, engaged workforce across all locations with streamlined tools that eliminate silos and enhance productivity.

Seamless Onboarding

Communications

Learning & Development

Culture & Recognition

Employee Management

Self-Service

PEOPLE

Empower Your Frontline

Your people are your most valuable asset. Build a connected, engaged workforce across all locations with streamlined tools that eliminate silos and enhance productivity.

Seamless Onboarding

Communications

Learning & Development

Culture & Recognition

Employee Management

Self-Service

OPERATIONS

Streamline Your Processes

Woven automates task management, optimizes daily workflows, and ensures your teams execute consistently across every location.

Automated Tasks

Location Audits

Shift Scheduling

Labor Planning

Risk Management

eSign & Policies

OPERATIONS

Streamline Your Processes

Woven automates task management, optimizes daily workflows, and ensures your teams execute consistently across every location.

Automated Tasks

Location Audits

Shift Scheduling

Labor Planning

Risk Management

eSign & Policies

OPERATIONS

Streamline Your Processes

Woven automates task management, optimizes daily workflows, and ensures your teams execute consistently across every location.

Automated Tasks

Location Audits

Shift Scheduling

Labor Planning

Risk Management

eSign & Policies

OPERATIONS

Streamline Your Processes

Woven automates task management, optimizes daily workflows, and ensures your teams execute consistently across every location.

Automated Tasks

Location Audits

Shift Scheduling

Labor Planning

Risk Management

eSign & Policies

FACILITIES

Optimize Your Equipment

Efficient facilities are the backbone of your operations. Woven helps you proactively manage maintenance needs, minimizing downtime and ensuring operational excellence.

Asset Management

Work Orders

Preventative Maintenance

Vendor Management

Part Inventory

Manufacturer Integrations

FACILITIES

Optimize Your Equipment

Efficient facilities are the backbone of your operations. Woven helps you proactively manage maintenance needs, minimizing downtime and ensuring operational excellence.

Asset Management

Work Orders

Preventative Maintenance

Vendor Management

Part Inventory

Manufacturer Integrations

FACILITIES

Optimize Your Equipment

Efficient facilities are the backbone of your operations. Woven helps you proactively manage maintenance needs, minimizing downtime and ensuring operational excellence.

Asset Management

Work Orders

Preventative Maintenance

Vendor Management

Part Inventory

Manufacturer Integrations

FACILITIES

Optimize Your Equipment

Efficient facilities are the backbone of your operations. Woven helps you proactively manage maintenance needs, minimizing downtime and ensuring operational excellence.

Asset Management

Work Orders

Preventative Maintenance

Vendor Management

Part Inventory

Manufacturer Integrations

Ready to Transform Your Operations?

Talk to our team about your current needs and biggest pain points, and we'll build a personalized demo customized for your organization.

Ready to Transform Your Operations?

Talk to our team about your current needs and biggest pain points, and we'll build a personalized demo customized for your organization.

Ready to Transform Your Operations?

Talk to our team about your current needs and biggest pain points, and we'll build a personalized demo customized for your organization.

Ready to Transform Your Operations?

Talk to our team about your current needs and biggest pain points, and we'll build a personalized demo customized for your organization.

Common Questions

Haven’t found what you’re looking for? Contact us

What makes Woven different from other multi-location management tools?

Is Woven suitable for my industry?

How does Woven help maintain consistency across all locations?

How does Woven improve employee onboarding and training?

Can Woven help with internal communication?

What operational tasks can Woven automate?

How does Woven ensure accountability across locations?

How does Woven handle facility maintenance requests?

What integrations does Woven support?

Can Woven help with opening new locations?

Is Woven easy to use for my team?

What kind of customer support does Woven provide?

Common Questions

Haven’t found what you’re looking for? Contact us

What makes Woven different from other multi-location management tools?

Is Woven suitable for my industry?

How does Woven help maintain consistency across all locations?

How does Woven improve employee onboarding and training?

Can Woven help with internal communication?

What operational tasks can Woven automate?

How does Woven ensure accountability across locations?

How does Woven handle facility maintenance requests?

What integrations does Woven support?

Can Woven help with opening new locations?

Is Woven easy to use for my team?

What kind of customer support does Woven provide?

Common Questions

Haven’t found what you’re looking for? Contact us

What makes Woven different from other multi-location management tools?

Is Woven suitable for my industry?

How does Woven help maintain consistency across all locations?

How does Woven improve employee onboarding and training?

Can Woven help with internal communication?

What operational tasks can Woven automate?

How does Woven ensure accountability across locations?

How does Woven handle facility maintenance requests?

What integrations does Woven support?

Can Woven help with opening new locations?

Is Woven easy to use for my team?

What kind of customer support does Woven provide?

Common Questions

Haven’t found what you’re looking for? Contact us

What makes Woven different from other multi-location management tools?

Is Woven suitable for my industry?

How does Woven help maintain consistency across all locations?

How does Woven improve employee onboarding and training?

Can Woven help with internal communication?

What operational tasks can Woven automate?

How does Woven ensure accountability across locations?

How does Woven handle facility maintenance requests?

What integrations does Woven support?

Can Woven help with opening new locations?

Is Woven easy to use for my team?

What kind of customer support does Woven provide?